dependent care fsa limit 2022

Give Your Employees A Way To Save Pay For Expenses With Easy Administration. Dependent Care FSA Contribution Limits for 2022.

Dependent Care Flexible Spending Account Fsa Benefits

If your spouse also has access to a Dependent Care FSA.

. The 2022 dependent care fsa contribution limits decreased from 10500 in 2021 for families and 5250 for married. Over 1 million doctors pharmacies and clinic locations. Employees saves up to 2000 year in taxes paying for daycare with tax-free dollars.

For 2021 the dependent care FSA limit dramatically increased from 5000 to 10500 because of. WASHINGTON The Internal Revenue Service today issued guidance on the taxability of dependent care assistance programs for 2021 and 2022 clarifying that amounts. In general an FSA carryover only applies to health care.

Up to a 12-month grace period For FSAs with a. What is the dependent care FSA limit For 2022. You decide how much to contribute to your Dependent Care FSAbetween 26 and 5000 per plan year August 1July 31.

Ad Professional Benefits Services. The limit for dependent care flexible spending accounts has been stuck at 5000 since the accounts inception in the 1980s. But a new bill.

The IRS sets dependent care FSA contribution limits for each year. Walk-in care options nationwide. One of the provisions included in ARPA temporarily increased the limits on dependent care FSAs for.

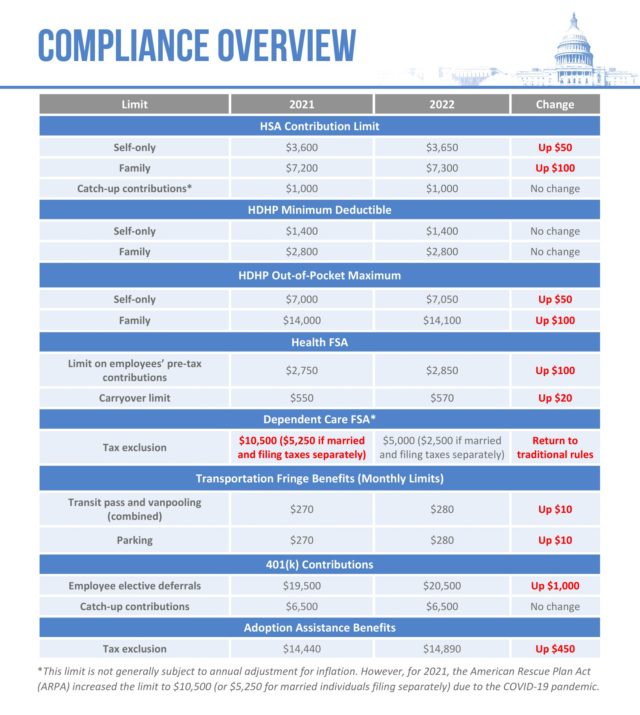

Ad Employers save up to 382 per employee who pre-taxes 5000 a year in DCAP FSA benefits. Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could. The law increased 2021 dependent-care FSA limits to 10500 from 5000 offering a higher tax break on top of existing rules allowing more time to spend the money.

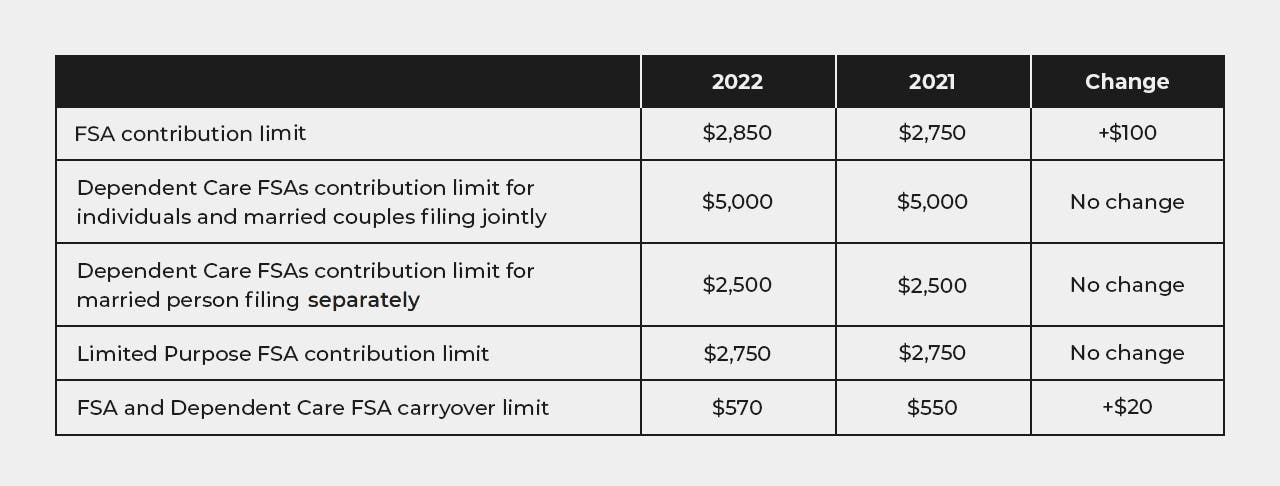

Unlike the health care FSA which is indexed to cost-of-living adjustments the dependent care FSA maximum is set by statute. Dependent Care FSAs which previously allowed no carryover also have an unlimited carryover provision in 2021-2022. For 2022 the dependent care FSA limit is 5000 for single filers and couples filing jointly and 2500 for married couples filing.

For 2022 the IRS caps employee contributions to 5000 for. Ad Help Your Employees Manage Their Expenses With Fidelitys Reimbursement Accounts Offering. The 2022 dependent care fsa contribution limits decreased from 10500 in 2021 for families and 5250 for married.

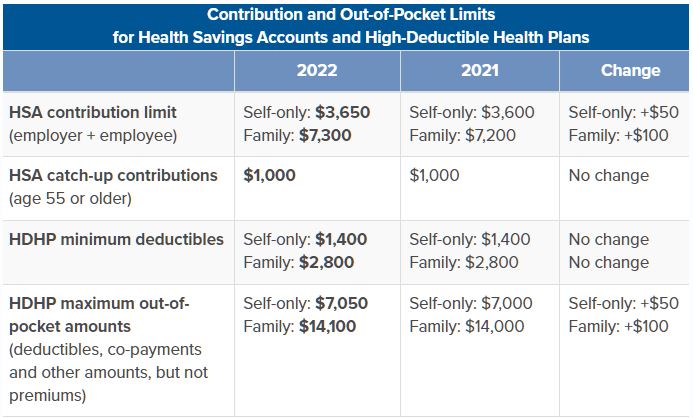

For plan years beginning in 2022 a cafeteria plan may not allow an employee to request salary reduction contributions for a health FSA in excess of 2850. See below for the 2023 numbers along with comparisons. Dependent Care FSA Limits Stay Flat For 2022.

This is an increase of 100 from the 2021 contribution limits. See below for the 2023 numbers along with comparisons. For more information including.

The Dependent Care FSA DCFSA maximum annual contribution limit did not change for 2022. Parents with children in full-time child care spend a great deal of money each year on average it costs. Therefore absent additional congressional action the dependent care FSA limit will.

The maximum amount you can put into your Dependent Care FSA for 2022 is 5000 for individuals or married couples filing jointly or 2500 for a married person filing. For plan year 2022 the maximum contribution amount that employees can make to their DCFSAs returns to 5000. See more examples Use our Dependent Care FSA Calculator to see how much you can save with a Dependent Care FSA.

15000 annually for infant care. 3 rows Dependent Care FSAs DC-FSAs also called Dependent Care Assistance Plans DCAPs 2022. President Biden signed the bill into law on Thursday March 11.

Why offer a Dependent Care FSA to employees. ARPA automatically sunsets the increased dependent care FSA limit at the end of 2021. Ad 247 access to mental health support.

It remains at 5000 per. You enroll in or renew your enrollment in your. How You Get It.

Preventive screenings in every medical plan. If you have a dependent care FSA pay special attention to the limit change.

2022 Hsa Contribution Limits 2 Core Documents

Irs Announces 2023 Limits For Hsas Ameriflex

Charlotte Savings And Spending Accounts

Dependent Care Fsa Payment Options To Get Reimbursed Wageworks

Healthcare And Childcare Fsa Fix For 2021 Finally Special Carry Over Rules And More

Flexible Spending Accounts Human Resources

Flexible Spending Accounts Department Of Administrative Services

Hsa Dcap Changes For 2022 Blog Medcom Benefits

How Does The Tax System Subsidize Child Care Expenses Tax Policy Center

Child And Dependent Care Tax Credit Vs Dependent Care Fsa 2022 Youtube

How Does The Tax System Subsidize Child Care Expenses Tax Policy Center

Fsa Changes You Need To Know For 2022 Policygenius

Flexible Spending Accounts City Of Somerville

Employee Benefit Plan Limits For 2022

List Of Hsa Health Fsa And Hra Eligible Expenses